Yield Farming Academy #3 Passive income in DeFi

This is the third lecture in the series on “Leech Protocol” from our Yield Farming Academy. Today, we will delineate the passive income streams on DeFi.

Here are the topics we will cover::

- What: – Explain what it is Yield Farming / Staking

- Why: – Explain the Benefits to users

- How: – Explain how it works + include examples of platforms

- Other considerations/tips:

- The Simplest Ways to Earn Passive Income in Crypto

So settle in, get ready to explore, learn, and discover together.”

What is Yield Farming/Staking?

Yield farming is the strategy of using crypto in DeFi protocols generate additional crypto. Unlike speculative operations where the multiplication of assets are carried out through buy and sell operations, yield farming is more like traditional farming where the user “grows” new assets (“harvests” as an example), and“locking” crypto in protocols and smart contracts (“soil” as an example).

One of the strategies behind yield farming involves depositing tokens into a liquidity pool within a decentralized finance (DeFi) platform ?. A liquidity pool can be described as a smart contract responsible for storing funds.

Participants receive liquidity provider (LP) tokens upon contributing liquidity thatrepresent their share of the pool’s assets. The protocol distributes transaction fees incurred by traders utilizing these pools among LP token holders. Some DeFi platforms may also offer native governance tokens as extra rewards, encouraging engagement and a decentralizing decision-making asset.

The second most popular yield farming strategy is Staking.

Staking in DeFi is the process of locking crypto assets in smart contracts for a profit. Unlike liquidity mining, participation in staking does not require the provision of two types of assets within the the liquidity pool. Staking performs the opposite task: it “freezes” tokens for a long time so that holders do not sell theirs for speculative purposes. This reduces the circulating supply, protecting token prices from a sellers’ pressure.

By staking their coins, participants help validate transactions and secure the network. In return, they receive rewards, such as additional cryptocurrency tokens or a share of transaction fees, depending on the specific blockchain protocol.

Staking is generally more straightforward than yield farming, as it involves fewer steps and often requires less active management. However, the rewards may be lower compared to some yield farming strategies.

The Benefits to Users

Both yield farming and staking offer several benefits to users

Benefits of Yield Farming:

- Potential for Higher Returns: Yield farming can offer relatively high returns compared to traditional savings accounts or other investment vehicles.

- Diversification: Users can diversify their cryptocurrency holdings by participating in various yield farming strategies across DeFi protocols.

- Liquidity Provision: By providing liquidity to decentralized exchanges, users contribute to the liquidity and efficiency of the DeFi ecosystem.

- Community Engagement: Yield farming often involves active participation in governance and decision-making processes of DeFi protocols, fostering community engagement and involvement.

Benefits of Staking:

- Passive Income: Staking allows users to earn passive income by holding and locking up their cryptocurrency holdings to support the network’s operations.

- Incentivizes Network Security: Staking incentivizes participants to contribute to the security and decentralization of blockchain networks, enhancing their overall stability and reliability.

- Alignment of Interests: Staking aligns the interests of network validators and token holders, as both parties benefit from the network’s success and stability.

Overall, yield farming and staking offer users opportunities to earn rewards while actively participating in the cryptocurrency ecosystem. However, users should know the associated risks and complexities before engaging in either activity.

Explain how it works + include examples of platforms.

Let’s delve deeper into how yield farming and staking work, along with examples of platforms for each:

Liquidity mining / providing:

Liquidity mining in decentralized finance (DeFi) protocols work by locking up cryptocurrencies in liquidity pools. These pools facilitate trading activities within the DeFi ecosystem.

Here is a step-by-step guideline:

- Providing Liquidity: Users deposit pairs of tokens into liquidity pools on DeFi platforms. These tokens are typically deposited in equal-value proportions. For example, in a decentralized exchange (DEX), a user might deposit an equal amount of ETH and USDC into a liquidity pool for the ETH/USDC trading pair.

- Earning Rewards: In return for liquidity, users receive liquidity provider (LP) tokens representing their share of the pool’s assets. Each time traders use these liquidity pools for transactions, they pay fees distributed among LP token holders. Additionally, some DeFi platforms distribute native governance tokens as rewards to LPs.

- Maximizing Returns: Yield farmers may employ various strategies to maximize their returns, such as providing liquidity across multiple platforms, participating in liquidity mining programs, or utilizing yield optimization tools.

Examples of Yield Farming Platforms:

- Uniswap: A decentralized exchange (DEX) where users can provide liquidity to various token pairs and earn trading fees.

- SushiSwap: A Uniswap fork offering additional features such as yield farming incentives and governance.

- Curve Finance: A decentralized exchange optimized for stablecoin trading, with opportunities for yield farming on stablecoin liquidity pools.

Staking:

Staking involves holding and locking up a certain amount of cryptocurrency in a smart contract or validator to participate actively in a blockchain network’s operations. Stakers help validate transactions and secure the network in exchange for rewards. Here are how they typically work:

- Acquiring Tokens: Users acquire tokens of a particular cryptocurrency that support staking.

- Staking Tokens: Users lock up their tokens in a staking contract or validator node, depending on the specific blockchain protocol. By staking their tokens, users contribute to the security and decentralization of the network.

- Earning Rewards: In return for staking their tokens, participants receive rewards, which can vary depending on factors such as the network’s consensus mechanism and tokenomics. Rewards may include additional cryptocurrency tokens or a share of transaction fees.

- Participation in Governance: Stakers often can participate in network governance, such as voting on protocol upgrades or changes.

Examples of Staking Platforms:

- Ethereum: Ethereum’s upgrade from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, allowing users to stake ETH to secure the network and earn rewards.

- Cardano is a blockchain platform that utilizes a PoS consensus mechanism. It allows users to stake ADA tokens to participate in network consensus and earn rewards.

- Tezos is a blockchain platform that supports staking. It allows users to delegate their XTZ tokens to validator nodes and earn rewards for securing the network.

- Polkadot: A multi-chain network that enables staking DOT tokens to secure the network and participate in governance.

Considerations/tips

Before entering into one of these types of earnings, you need to weigh the pros and cons and responsibly approach any pitfalls that may occur. Here are some considerations and tips:

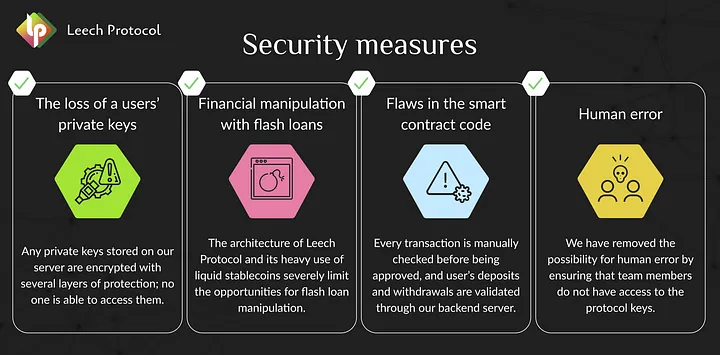

- Understand the Risks: Yield farming can be lucrative, but it also comes with risks such as impermanent loss, smart contract vulnerabilities, and market volatility. Understanding these risks is crucial, as is investing only what you can afford to lose.

- Research Projects Thoroughly: Before participating in yield farming, thoroughly research the DeFi protocols and platforms you plan to use. Look into their security audits, tokenomics, team backgrounds, and community reputation.

- Diversify Your Investments: Avoid putting all your funds into a single yield farming strategy or platform. Diversification helps mitigate risk in adverse events affecting a particular protocol or token.

- Stay Informed: Stay up-to-date with the latest developments, news, and trends in the DeFi space. Changes in protocol parameters, governance decisions, or market conditions can impact your yield farming strategy.

- Monitor Gas Fees: Gas fees on the Ethereum network can fluctuate significantly, affecting the cost-effectiveness of yield farming activities. Keep an eye on gas prices and consider timing your transactions during periods of lower congestion.

- Be Mindful of Impermanent Loss: Impermanent loss occurs when the value of tokens in a liquidity pool diverges from the same tokens held individually. Understand how impermanent loss works and its potential impact on your returns.

- Be Prepared for Lockup Periods: Understand that staking often involves locking up your tokens for a certain period. Consider your liquidity needs and investment horizon before committing to a staking strategy.

- Assess Rewards and Risks: Compare the potential rewards offered by different staking protocols, but also consider the associated risks, such as slashing penalties for validator misbehavior or network attacks.

- Consider Tokenomics: Evaluate the tokenomics of the staking token, including its supply dynamics, inflation rate, and distribution mechanism. Tokens with a limited supply or deflationary mechanisms may have better long-term value potential.

The Simplest Ways to Earn Passive Income in Crypto

- Staking Platforms

- Lido is a decentralized staking platform enabling users to stake their Ethereum (and other supported cryptocurrencies) while maintaining liquidity. It allows for participation in Ethereum’s Proof of Stake consensus without requiring the minimum staking amount or locking up assets. Stakers receive stETH (staked ETH) in return, representing their staked ETH plus earned rewards, which remain liquid and can be used in various DeFi applications. Lido aims to simplify the staking process and make it more accessible to a broader range of users.

- Frax is a cryptocurrency platform that introduces a unique concept in the stablecoin sector. It’s the first stablecoin system to implement a fractional-algorithmic model. This model means that the Frax stablecoin (FRAX) is partially backed by collateral (like USDC) and partially stabilized algorithmically. The collateralization ratio to algorithmic stabilization can vary, providing a secure and scalable stablecoin. The platform also includes the Frax Share token (FXS), which acts as the governance token and accrues fees and seigniorage revenue generated by the FRAX stablecoin. Frax’s innovative approach aims to balance the capital efficiency of algorithmic stablecoins with the confidence provided by fully collateralized stablecoins.

- Yield Aggregating Platforms

- Leech, etc.

- Yearn.finance

- Compound (COMP)

- Aave

- Balancer

- Harvest Finance (FARM)

- Lending Platforms

- Aave, etc.

- Compound

- MakerDAO

- BlockFi

- Nexo

- Celsius Network

- S2E Platforms

- Cirus, etc.

- Ethereum 2.0 (Beacon Chain)

- Cardano (ADA)

- Polkadot (DOT)

- Tezos (XTZ)

- Cosmos (ATOM)

- Being an LP

- Uniswap

- SushiSwap

- Balancer

- Curve Finance

- PancakeSwap

- Bancor