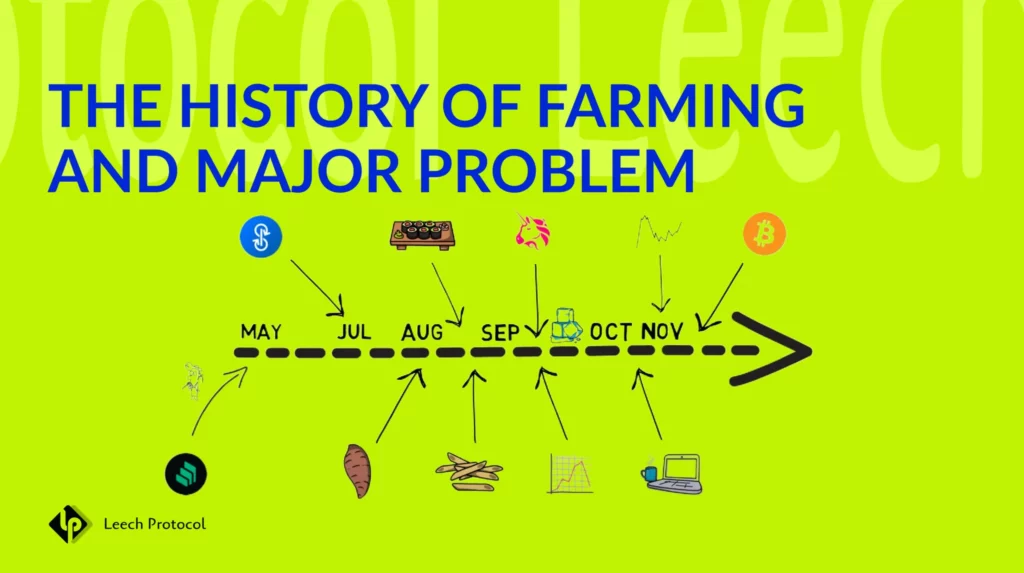

The history of farming and major problem

Home | News & Insights The history of farming and major problem The Journey of Farming was started in the summer of 2020 from a few DeFi projects, like Synthetix, Compound, Yearn Finance… But all this started early before. All major players like Yarn Finance, YAM, and SushiSwap were launched during the DeFi Summer. The history of farming and major Problem To learn more about the history of farming and DeFI, please check this video. The problems of farming “liquidity mining” By creating farming incentivization or “liquidity mining programs” protocols printing their GOV tokens, and giving them as a reward to liquidity providers. As a result, we see more and more new GOV tokens on the market, significantly lowering the price. As an essential part of Farming, liquidity mining is an Inflationary mechanic in the protocol tokenomics. Healthy tokenomics Healthy tokenomics should have deflationary and Inflationary mechanics. By using both of them, the protocol can have a part of control over their GOV token price. In tokenomics, deflationary and inflationary mechanics refer to managing a token supply. Deflationary mechanics are designed to reduce the supply of a token over time. This can be achieved through various means, such as burning tokens (permanently removing them from circulation) or using a portion of transaction fees to buy back and retire tokens. Deflationary mechanics are intended to increase the value of a token by making it more scarce. Inflationary mechanics, on the other hand, are designed to increase the supply of a cryptocurrency over time. This can be achieved through various means, such as issuing new tokens (Farming) or using a portion of transaction fees to fund the development of the cryptocurrency. Inflationary mechanics are intended to increase the liquidity of a cryptocurrency and make it more widely available. Deflationary and inflationary mechanics can have a significant impact on the value of a token. Deflationary mechanics can increase the value of a cryptocurrency by making it more scarce, while inflationary mechanics can decrease the value of a cryptocurrency by increasing the supply. It is essential to carefully consider the implications of these mechanics before investing in a GOV token. What should you do next? Share: Twitter Facebook Telegram